The new concessionary company tax rate of 27.5% (which is gradually decreasing to 25% from 1 July 2021) for companies turning over up to $50m has a number of caveats which means the headline discount could be illusionary for some enterprise structures.

While it can be simple if you have a trading company turning over less than $50m, that company will generally qualify for the discounted tax rate.

However, if we move beyond this base simplicity to a enterprise structure that has risk minimisation layers, you are likely to pay the profits out of the trading entity into passive internal funding/equity holding entities.

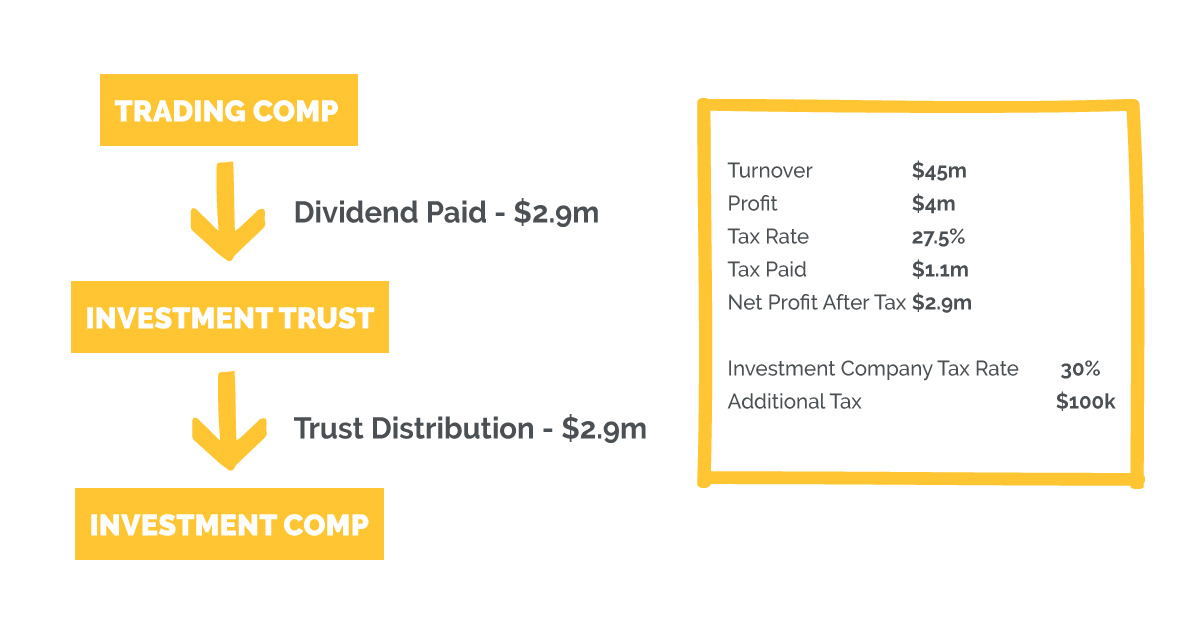

In such circumstances, your profits may be returned to the non-concessionary 30% tax rate. A simple example of this problem is illustrated below.

In this case, we are simply moving profits out of the risky trading enterprise as part of a risk management strategy. Those funds are to either be deployed for business or investment purposes elsewhere and/or potentially loaned back to the trading entity under a loan and security agreement from the investment company.

The result is we return to the 30% tax rate at a cost of $100k per annum.

Obviously, this becomes an expensive way to do risk minimisation.

Depending on your circumstances, an expert in private corporate groups should be able to navigate the issues by tweaking the enterprise structure. This would ensure the risk minimisation objectives are achieved while retaining the concessionary 27.5% company tax rate.

Remember, a good enterprise structure should achieve the following objectives:

- Risk Minimisation

- Tax Efficiency

- Functionality

Toohey Reid are enterprise structure experts. We have been advising medium-sized private businesses and successful professionals on enterprise structure design for 20 years. Contact us today to see how we can help your business flourish.

This is what a Can advisor looks like, what does your advisor look like?

General Advice Disclaimer

General advice warning: The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.

Did you like this article? Email it to a friend